5 Top Reasons Why You Need To Manage Finances in 2022

Manage Finances to take charge of your money effectively.

My family and friends were not aware of this, but I was living beyond my means borrowing my lifestyle. There was nothing under my name. A big portion of my income goes to pay my home rentals and monthly utilities. It was daunting filled with a lot of emotions. I can feel intimidating when there’s not enough money to cover minimum payments on my credit cards.

I know it can be frightening to start your year to manage finances because often, people see this as complex and the most boring thing to do. But, managing finances are money habits that will help you develop routines then over time they will have a powerful impact on achieving financial goals.

If you’re feeling lost about managing your finances, you’re in the right place.

Because I’ve been there myself and in this post, I will be going to cover 5 top reasons why you need to consider managing your finances and take these solid steps to help you limit the stress associated with your current financial condition.

The Top 5 Reasons Why You Need To Manage Your Finances in 2022

1. Eliminate stress

No wonder money causes stress and anxiety for so many. If the debt is part of sleepless nights, it’s never too late to make a plan and fix the chaos with your money. When we are stressed about money, our minds can spin out of control and our decision-making can be detrimental to our life and family.

Manage Finances Step #1: Tackle debt

The first solid step to manage your finances successfully is to wipe out toxic debt first. It should be your priority if you’re on a mission to manage finances because interest rates can consume up your budget and even produce more debt. So, tackle your debt with the proper payment schedules.

A debt repayment calculator will help you plan how much you want to allocate your money to pay off your debt faster to save those high interest and avoid recurring debt.

You may be able to speed things up with some go-to tips: 8 Money Management Tactics I Used To Pay My Debt Faster in 2 years.

2. Give your kids the best education

Poverty and education are totally interconnected to each other. Every parent wants to give their kids the best education. If you’re a mom (like me), you always want to give the best for your kids and if you failed to manage your money effectively, you may stop sending your kids to a better school. This may affect your child’s well-being and future career.

Manage Finances Step #2: Set a monthly budget

You may want to start setting a monthly budget. Start with knowing how much money you are making and if you are married, then how much is the total amount of money you and your spouse make. Once you’ve figured out your total income and expenses, then creating a budget each month and sticking with it will help you decrease your stress levels and save for the best education for your kids.

You may be able to speed things up with some go-to tips: How to make a budget the 40/10/50 rule.

3. Don't rely on social security alone during retirement

Social Security is the major source of income when most people reach the age of retirement. Understand as we age, our medications and healthcare costs are increasing. Elderly people don’t have their medical check-ups due to lack of money even when they have symptoms. Social security should be your last resort to get the best care you want when you get older.

Manage Finances Step #3: Know your retirement numbers

Sometimes, planning for the future can be set to the side, something that you’ll put attention to for another day. However, “another day” has a tendency to get set aside again and again until it will be forgotten. To avoid this, take charge today by calculating your retirement savings for better preparation.

Also, instead of having a vague goal like “I want to retire comfortably”, make your goals specific something like, “pay my home mortgage before I reach 60. I want to travel twice a year with no debt.”

You may be able to speed things up with some go-to tips: The 5 effective ways I use how to set up goals and attain them (with my personal short-term and long-term goals examples).

4. Have full control to make a decision

Managing your finances well can be advantageous for you when making a decision. Are you thinking to open a business? Or thinking of owning a house? Or maybe take your family to the best family travel getaways next month?

When you manage your finances well, you can easily make a better decision on where and how you’re spending your money. Whereas financial worries can harm your abilities to make better life choices.

Manage Finances Step #4: Treat your finances like an Inc.

You can create your own personal financial statement and cash flow. Monitor the ins and outs of your money to determine if you have a positive or negative net cash flow each month. Managing your cash flow properly allows you to save more and invest (as you see fit) to improve your net worth.

You don’t need to use any sophisticated apps. I personally use this simple worksheet in excel that helps me a lot to measure my cash inflows (money I earn) and my cash outflows (money I spend). I’ve been using this and working for me well for twenty years now.

You can download my simple excel worksheets below for FREE:

5. Have a better quality of life

Managing your finances well and when you think of ways to keep your earnings higher than your expenses, will take a lot of pressure from your current financial status. And this will let you enjoy day-to-day life. Be happier and even improve your quality of life and your family.

Manage Finances Step #5: Continue to improve your net-worth

Even with a full-time job, earning extra income will improve your net worth. Create different streams of passive income, so let the money work for you later on. And even if you double your income, continue to live within your set budget, monitor your money, save more, and invest!

Here’s why people go broke even after winning a lottery: It’s because of a lack of financial literacy. Without it, their financial decisions and the actions they make, they assume they have financial security for life. No budget. No savings. And they do not monitor the flows of their money. As a consequence, they get their life even more miserable.

Whether you’re looking to create a personal budget spreadsheet or just get a better grasp on money management, you can get my personal budget spreadsheet that you can instantly download today!

This can help you determine where your money is going each month. Creating a budget with a template can help you feel more in control of your finances and let you save money for your goals.

Final Thoughts

Being stressed about money can trigger harmful thoughts such as “I am a failure at everything” or “I am poor right now and will be poor forever”.

Well, you’re absolutely wrong!

Our anxiety wings up when we are not confident in our own ability. Remember I’ve been there myself. We all have our own financial difficulties, but we need to accept the fact of lack of financial literacy is one of the major reasons why we manage our finances so badly.

Managing finances well doesn't happen overnight, it's a process and you need to embrace the process.

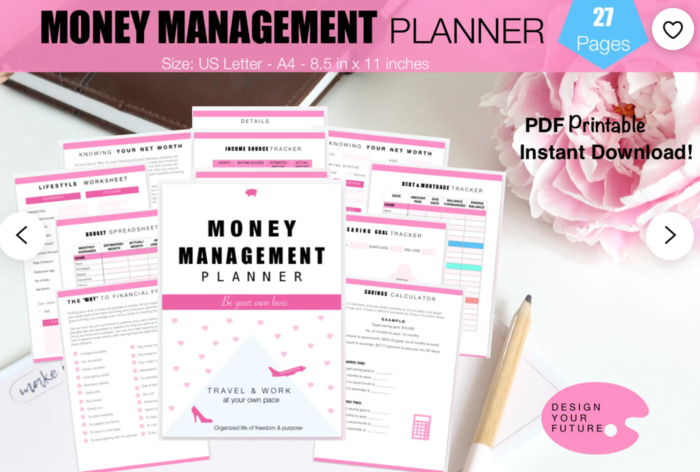

The stress about money will pop out from time to time, but being responsible with your money using this money management planner template can help you feel more in control of your financial situation.

Take the time to see what positive changes you can make to manage finances and then turn that changes into routines for achieving true financial freedom to have a better quality of life.

📌Pin me for later!

MORE LIFE SKILLS RESOURCES:

How to set SMART life goals?

Check my 3-part blog series about the goal-setting process to crush goals.

How to manage your personal finances?

Head on to money matters to help you manage your money wisely.

How to work at your own pace?

Check my be your own boss journey doing what you love and earn without any fancy office.

How to find your life purpose?

Check these 4 Japanese living good secrets that work.

How to turn your travel dream into reality?

Check my 7 chapters jam-packed ebook to help you plan, pack, and save money faster for your next trips!

About Jeng Cua

After borrowing her lifestyle living paycheck to paycheck, this work from anywhere mom wouldn’t let anything stop her from chasing her dreams. Now, Jeng has achieved more than she ever imagined. Her mission is pretty simple – to help you love your life and family using her four distinct life systems.